|

||||||||

|

|

|

2020-03-30 ArtNo.46735

◆Growth pangs: Budget plans may go haywire as Covid-19 wreaks havoc

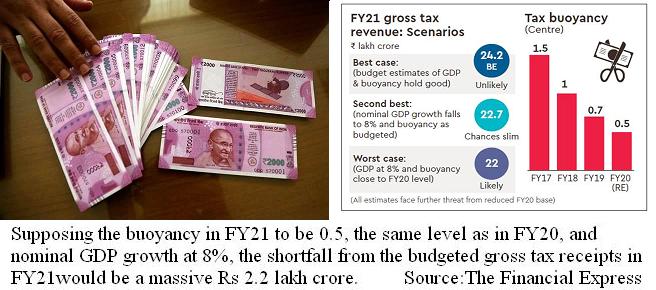

【New Delhi】Given the spread of Covid-19 and its impact on domestic and global demand, India's economic growth could fall considerably from the budgeted level. When the Centre assumed tax buoyancy of 1.2 for FY21, as against just 0.5 seen in FY20 (revised estimate), many thought that it was optimistic, if not unrealistic. Assuming the actual nominal GDP growth for FY21 at 8% as against the budgeted 10%, the tax buoyancy required to achieve the budgeted growth in gross tax receipts (GTR) of 12% will be an impossible 1.5. Put differently, even if the assumed tax buoyancy of 1.2 holds true, the lower GDP growth would result in a tax revenue (GTR) shortfall of Rs 1.5 lakh crore next fiscal, from the budgeted Rs 24.2 lakh crore. Of course, since the buoyancy budgeted is really high under current circumstances, the GTR shortfall will likely be far higher. 【News source】 Growth pangs: Budget plans may go haywire as Covid-19 wreaks havoc ○One world:The aim of SEAnews Your Comments / UnsubscribeTweet to @TwitterDev SEAnews MessengerSEAnewsFacebookSEAnews eBookstoreSEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |