|

||||||||

|

|

|

2020-03-13 ArtNo.46699

◆There was enough time to put together plan for YES Bank: Former RBI Governor Rajan

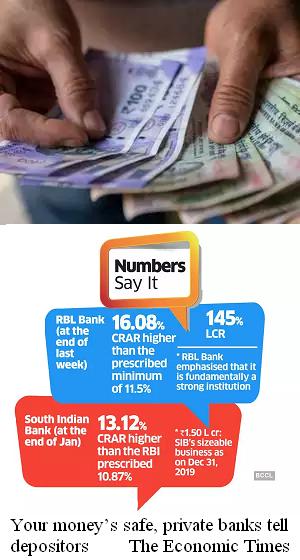

【New Delhi】Former RBI governor Raghuram Rajan on March 11 said there was a lot of time to put together a plan for YES Bank which had given "enough" notice about the problems it was facing. Crisis-ridden YES Bank was put under a moratorium last week, with the RBI capping withdrawals at Rs 50,000 per account and superseding its board. State Bank of India (SBI) is set to pick up 49 per cent stake in the lender under RBI's reconstruction plan. "YES Bank had given us enough notice that it has been in difficulty...so there was enough time to put together a plan. "I hope what we have got is best available (plan), but I don't want to second guess, because I don't know the details," Rajan said in an interview to CNBC-TV18. To a question related to RBI's policy rate, Rajan said no amount of interest rate cut is going to help if credit growth is weak. "Are companies willing to borrow and invest on the basis of lower interest rates... Unless we fix the financial system, it's like trying to send water through broken pipes. It's going to leak out all over the place," he said. On when will India regain the economic growth rate of 6-7 per cent, Rajan said it will happen when the government takes appropriate action. ○Yes Bank crisis impact: Your money's safe, private banks tell depositors  【Mumbai】The Yes Bank crisis is having a contagion impact on other private banks, forcing these lenders to clarify their position and address depositor concerns on their capital base and liquidity. RBL Bank, Karnataka Bank and South Indian Bank, in separate communications to their customers, have clarified that rumours around their financial health and stability are untrue and not based on facts. This also follows an RBI (Reserve Bank of India) clarification about the safety of banking deposits on March 08. RBI's tweets were in response to an erroneous comparison by a news channel between the ratio of deposits and market capitalisation of private sector banks, which subsequently went viral through whatsapp forwards. ○Yes Bank rescue: ICICI Bank, HDFC, Kotak could play big roles in SBI's plan  【Mumbai】State Bank of India (SBI) is striving to rope in local financial services groups like ICICI, HDFC, Kotak and Axis along with a few private investors as part of a strategy to infuse capital and revive Yes Bank. SBI is simultaneously examining a deal with bondholders for conversion of Yes Bank's additional Tier 1 (AT 1) securities into shares of the private bank. 【News source】 There was enough time to put together plan for YES Bank: Raghuram Rajan Yes Bank crisis impact: Your money’s safe, private banks tell depositors Yes Bank crisis impact: Your money’s safe, private banks tell depositors ○One world:The aim of SEAnews Your Comments / UnsubscribeTweet to @TwitterDev SEAnews MessengerSEAnewsFacebookSEAnews eBookstoreSEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |