|

||||||||

|

|

|

2017-05-20 ArtNo.46006

◆70% of all goods and some consumer durables to become cheaper under proposed GST regime

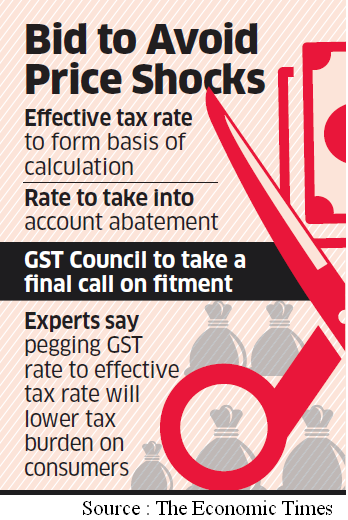

【New Delhi】A number of goods such as cosmetics, shaving creams, shampoo, toothpaste, soap, plastics, paints and some consumer durables could become cheaper under the proposed goods and services tax (GST) regime as most items are likely to be subject to the rate of 18% rather than the higher one of 28%. India is likely to rely on the effective tax rate currently applicable on a commodity to get a fix on the GST slab, said a government official, allowing most goods to make it to the lower bracket. For instance, if an item comes within the 12% excise slab but the effective tax is 8% due to abatement, then the latter will be considered for GST fitment. Going by this formulation, about 70% of all goods could fall in the 18% bracket. By slashing costs and boosting efficiency, GST will result in GDP growth getting a 1-2 percentage point lift, according to experts. ○Transition to GST will take one year and will have some pains: Arvind Panagariya  【New Delhi】As the government sets the deadline of Goods and Services Tax (GST) implementation on July 1, the Niti Aayog Vice Chairman Arvind Panagariya Tuesday (11-04-2017) said the transition to the new indirect tax regime will take at least one year and it will also have initial pains. He said there will be challenges for the government and industry both during the transition period to India’s vast indirect tax regime. More than 11 indirect taxes are expected to be merged into GST which includes state VAT, octroy and other local levies. Though the large enterprises have been gearing up to comply with the GST, there are a lot teething problems for small and medium enterprises. It is still not clear how the transition will impact their businesses. The GSTN which is providing the IT infrastructure for implementation and administration of GST has said that all registered tax payers in the present system will be migrated to the GST regime by November 8. The authorities have already started giving certificate of registration to all entities registered under the earlier laws. ○GSTN may ease eligibility for third-party service providers  【New Delhi】Several startups have been eyeing the opportunity of getting to directly interact with the Goods & Services Tax (GST) system to help enterprises file their returns once the GST regime rolls out. They may now get the chance since the nodal agency in charge of the technological infrastructure for GST is considering relaxing the eligibility criteria for thirdparty service providers. The GST Network (GSTN), which had shortlisted 34 GSPs (GST suvidha providers) from over 300 applicants in the first phase in December, is set to open the second phase of applications this month and is likely to revise certain criteria, according to sources aware of the matter. Anyway, for e-commerce entities, the next few weeks would be tiring. They’re race against time to equip themselves for the GST regime that is likely to be effective from July. E-commerce companies are scheduling classes for their sellers, both online and offline, hiring more people, revamping their technology and warehousing. On the other hand, to avoid multiple taxation under the coming GST, diamond jewellers have urged they be exempted from levies on the processing of diamonds. Thousands of small and medium size units, with an estimated 100,000 work force, primarily in Gujarat, currently purchase (rough) diamonds from sightholders (authorised agents) of large global miners like De Beers, Rio Tinto and Alrosa, to process these. After processing, they sell these to large processors. In a move aimed at lowering consumption of tobacco products, the health ministry has sought to tax all such products, including bidis, at 28 per cent as well as impose higher cess under the new GST regime. 【News source】 70% of all goods and some consumer durables to become cheaper under proposed GST regime Transition to GST will take one year and will have some pains: Arvind Panagariya GSTN may ease eligibility for third-party service providers Bracing for the indirect tax regime: E-tail firms get GST ready Jewellers want small- and medium-size diamond processors exempted under GST Government wants 28 per cent tax on all tobacco products ○One world: The aim of SEAnews ◆Recruitment of Ad-SEAnews CanvassersYour Comments / UnsubscribeSEAnews MessengerSEAnewsFacebookSEAnewsGoogleSEAnews eBookstoreSEAnews eBookstore(GoogleJ)SEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |