|

||||||||

|

|

|

2017-01-30 ArtNo.45904

◆Customers get Bhim App, but aren’t finding avenues for use

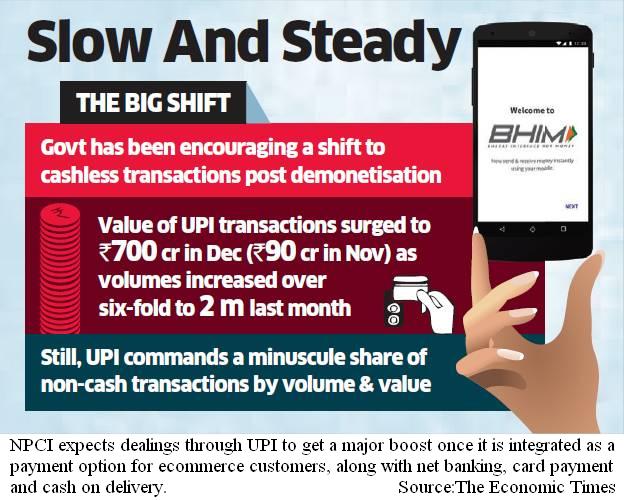

【New Delhi】When Prime Minister Narendra Modi launched the Bhim app last week, the common platform for the Unified Payment Interface was touted as the next big thing that would help widen the adoption of cashless transactions in the country. Yet, the National Payments Corporation of India, the agency that handles all retail payment systems in the country, is “getting impatient” with companies such as Flipkart, Amazon, Paytm and Indian Railway Catering & Tourism Corporation for taking time to integrate with UPI, which forms the core of Bhim. Llast week, AP Hota, managing director, said NPCI is “not very happy” with the 70,000 UPI transactions a day, the figure before the Bhim app was launched on December 30. NPCI said that as on Wednesday (04-01-17), the number of transactions had increased to 1,90,000 per day. According to the Financial Express (January 24, 2017), digital banking is catching on with the value of transactions on the Unified Payments Interface (UPI) platform on its way to the Rs 1,000-crore mark in January. In November, the platform had reported transactions worth just Rs 90 crore. Moreover, the gap between the value of transactions on UPI and that on prepaid instruments or wallets is narrowing. While the gap in December was Rs 1,413 crore, the difference so far in January is just Rs 309 crore with more than half the month gone. ○Note ban throws Punjab’s footwear sellers hopelessly out of step  【Ludhiana/ Sangrur】Seated in front of his shop in Sangrur, which displays colourful Punjabi juttis (footwear), Upvinder Taneja, who doubles as part-time journalist, points to the Paytm sticker on his store window. It’s a commercial concession to the harsh realities of a strident, government-initiated campaign for a cashless society. But in small towns like Sangur, neither the enticing colours of the juttis nor the convenience promised by Paytm attract customers. “It’s been more than a month since I registered on Paytm, but who’s going to use it here?” Taneja said. “In over a month, I’ve received only about Rs 2,000-3,000 through Paytm.” Before November 8, when the demonetisation of high-denomination currency took effect, Taneja made daily sales of Rs 2,000-3,000, almost all of it in cash. Today, that has dropped by half to Rs 1,000-1,500 a day. ○What they don’t tell you about digital payments  【New Delhi】For the Government and its supporters, pushing towards cashless or less-cash transactions seems to have become the silver bullet to deliver solutions to all sorts of problems, from fighting corruption, to ending poverty, to modernising society, even to ensuring sustainable development. There is a basic confusion in this perception, which mixes up the effects of strategies to increase production and provide quality employment, with the effects of a change in the manner in which transactions are conducted and settled. To begin with, it is wrong to presume that currency use declines as countries grow richer or reach more advanced stages of development. As Chart 1 shows, there is really no relation between per capita income and the value of currency in circulation, or between levels of corruption and cash in circulation. 【News source】 Customers get Bhim App, but aren’t finding avenues for use Digital banking: Unified Payments Interface soars, set to hit Rs 1,000 cr mark Note ban throws Punjab’s footwear sellers hopelessly out of step What they don’t tell you about digital payments ○One world: The aim of SEAnews ◆Recruitment of Ad-SEAnews CanvassersYour Comments / UnsubscribeSEAnews MessengerSEAnewsFacebookSEAnewsGoogleSEAnews eBookstoreSEAnews eBookstore(GoogleJ)SEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |