|

||||||||

|

|

|

2017-01-30 ArtNo.45898

◆Can’t say demonetisation has failed

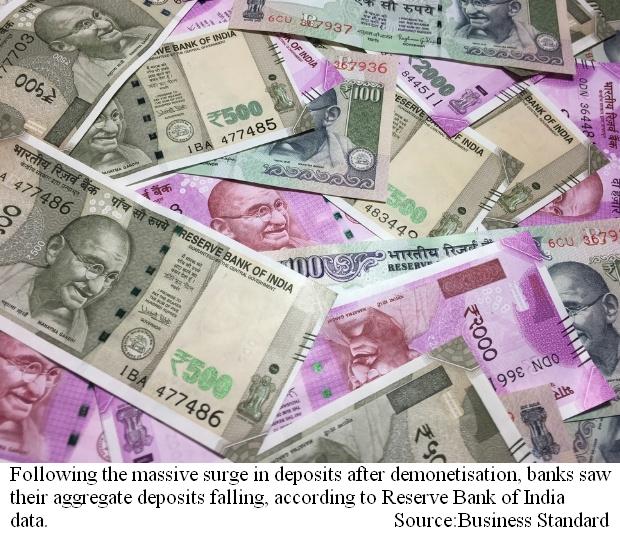

【New Delhi】To go by sums that have returned to banks would be misleading. Let’s wait till the I-T department completes investigations It is now clear that about 90 per cent of the demonetised currency has found its way back to banks (both by over-the-counter transfer and deposits in bank accounts). Consequently, the expectation of a windfall profit for the Reserve Bank and the Government that could accrue from unreturned demonetised currency would remain unfulfilled. The unreturned demonetised currency connotes 100 per cent taxation on the same. Does this mean the entire exercise of demonetisation failed miserably? What are the different ways in which the demonetised currency found its way to the banks? .... <1>Over the counter exchange, <2>Bank deposits, <3>Prime Minister's People Money Scheme (PMJDY:Pradhan Mantri Jan-Dhan Yojana) .... -Omit- It was reported that the total currency issued over the counter was about Rs 35,000 crore, which would be about 2.3 per cent of the total demonetised currency. -Omit- There are indications that out of demonetised currencies worth Rs 15.44 lakh crore, about Rs 14 lakh crore might have found its way back to bank deposits. -Omit- The third category covers 48 lakh Jan Dhan accounts, which attracted deposits worth Rs 41,523 crore between November 8 and December 23. In addition deposits of Rs 30,000-50,000 were made in 4.86 lakh accounts accounting for another Rs 2,000 crore. -Omit- (TS Ramakrishnan) ○Deposits fall for first time since note ban  【New Delhi】Following the massive surge in deposits after demonetisation was announced on November 8, banks saw their aggregate deposits falling for the fortnight to December 23, according to Reserve Bank of India (RBI) data. For the fortnight to December 23, deposits collected by banks stood at Rs 1,05,16,237 crore, down by 0.7 per cent compared with Rs 1,05,91,313 crore collected during the fortnight ended December 9, RBI said on Thursday. During the fortnight ending November 25, deposits at banks had soared to Rs 1,05,17,719 crore from Rs 1,01,14,803 crore on November 11. Banks were flush with deposits after the government scrapped the old high-denomination notes worth Rs 20.51 lakh crore, constituting over 86 per cent of the currency in circulation. ○RBI in the process of counting old notes returned to banks  【Mumbai】The Reserve Bank of India (RBI) on Thursday (05-01-17) clarified it was still counting how many old notes have been returned to the banking system, to eliminate double counting. Therefore, it said the numbers being quoted should not be construed as verified. RBI is reconciling the numbers provided by banks against the actual cash stashed in currency chests. Media reports suggested that anything between Rs 14.5 lakh crore and Rs 15 lakh crore may have come back to the banking system, against Rs 15.4 lakh crore worth of old Rs 500 and Rs 1,000 notes. These notes are now called specified bank notes (SBN) by RBI. "Now that the scheme has come to an end on December 30, 2016, these figures would need to be reconciled with the physical cash balances to eliminate accounting errors/possible double counts etc," a statement on the RBI website said. 【News source】 Can’t say demonetisation has failed Deposits fall for first time since note ban How many old notes did people deposit? RBI says it is still counting them ○One world: The aim of SEAnews ◆Recruitment of Ad-SEAnews CanvassersYour Comments / UnsubscribeSEAnews MessengerSEAnewsFacebookSEAnewsGoogleSEAnews eBookstoreSEAnews eBookstore(GoogleJ)SEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |