|

||||||||

|

|

|

2017-01-30 ArtNo.45895

◆Happy days ahead! Cash crunch may ease by Feb-end, says SBI report

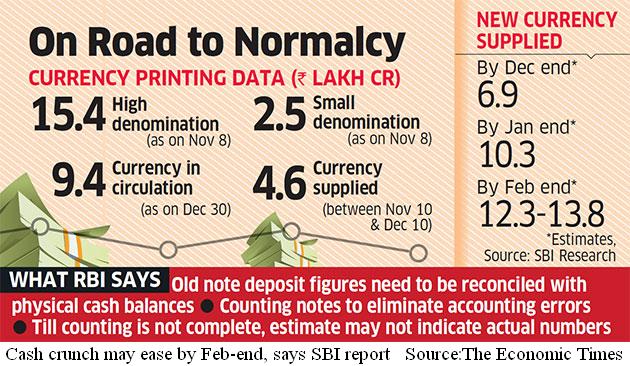

【Mumbai】The Reserve Bank of India replaced as much as 44% of the currency extinguished by demonetisation with new notes by December 30, according to a State Bank of India report. India's currency supply is likely to return to near normal by February end and growth, which has been hit by the withdrawal of Rs 500 and Rs 1,000 notes, is likely to bounce back faster than earlier expected, said the analysis by India's largest commercial bank. ○Notes ban: GDP may slump to 5% in Dec quarter, says HSBC  【New Delhi】India’s GDP is likely to have grown at a much slower—than—expected pace of 5 per cent in the October—December period and may see a 6 per cent growth in the following quarter due to a slow down in manufacturing and services sectors post demonetisation, says an HSBC report. According to the global financial services major, activity data across manufacturing and services as well as consumption and investment have clearly taken a hit after November 8, 2016, when the government announced scrapping old 500/1,000 rupee notes. “We expect GDP to grow 5.0 per cent in the October— December quarter and 6.0 per cent in the January—March quarter, about 2 percentage points lower than we had expected before the demonetisation was announced,” HSBC said in a research note. Post the March quarter, the economic growth is expected to normalise gradually towards the 7 per cent level, it added. “Thereafter (after January—March period), we expect growth to normalise gradually towards the 7 per cent ballpark, but remain shy of the 7.5—8 per cent range in FY18, due to adjustment costs that businesses and consumers face, in the process of formalisation and digitisation,” the report added. ○Demonetisation impact: Impact of MCLR on banks may not be great, says Nomura  【New Delhi】India’s financial stocks, especially corporate banks, have been very resilient over the past two days in spite of a large 90bp MCLR cut by the SBI. In this note we discuss the MCLR rate mechanism and possible impact on asset yields for banks over the next 6-12 months. While only a small proportion of current system loans is linked to MCLR and even that will reset with a 6 to 12 month lag, we believe refinancing will be large given the large rate reduction benefit for corporate, individuals, and this related migration from base rate to MCLR rates could lead to margin/PPOP pressure for banks. For most large banks MCLR-linked loans currently account for 15-20% of total loans, with the exception of the SBI for whom the proportion of MCLR-linked loans is 40%. The rest of the floating loans are based on base rate and the reduction in base rates has been significantly larger. Since base rate-linked loans form 40-50% of banks’ loan book, MCLR cuts don’t automatically affect yields of base rate-linked loans. 【News source】 Happy days ahead! Cash crunch may ease by Feb-end, says SBI report Notes ban: GDP may slump to 5% in Dec quarter, says HSBC Demonetisation impact: HSBC warns that India’s GDP may slump to 5% in Q3 Demonetisation impact: Impact of MCLR on banks may not be great, says Nomura ○One world: The aim of SEAnews ◆Recruitment of Ad-SEAnews CanvassersYour Comments / UnsubscribeSEAnews MessengerSEAnewsFacebookSEAnewsGoogleSEAnews eBookstoreSEAnews eBookstore(GoogleJ)SEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |