|

||||||||

|

|

|

2016-08-31 ArtNo.45835

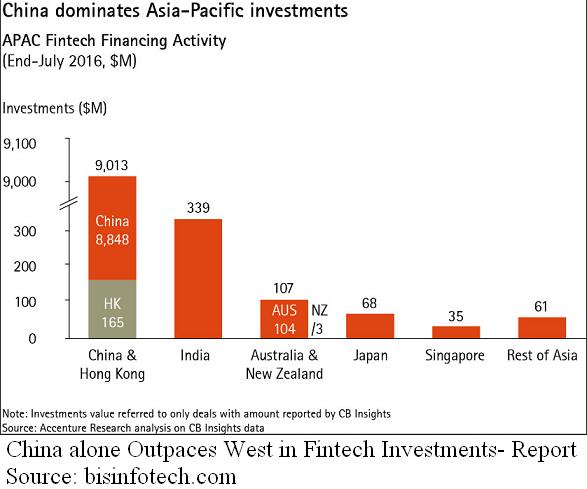

◆China leads global investments in fintech followed by India: Accenture

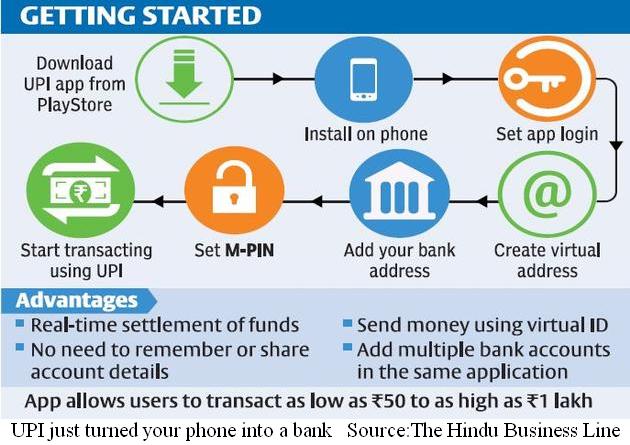

【Pune】Investments in Asia-Pacific financial technology (fintech) ventures, primarily in China, reached $9.62 billion as of July 31, more than twice the $4.26 billion invested in the region in all of 2015, according to an Accenture analysis of CB Insights data India stood second in this analysis, with investments of $339 million. "China's established companies, rather than nascent startups, are at the forefront of the fintech trend in the region," said Beat Monerrat, Accenture senior managing director, Financial Services Asia-Pacific. "Fintech companies with major backers such as Alibaba and JD.com are focussed on providing positive end-to-end customer experiences, which includes payments and lending. This is transforming China's financial services industry and is consistent with the global 'Fourth Industrial Revolution', which is bringing innovation from non-traditional competitors to the financial services industry." Investments in the APAC region have overtaken North America, which as of 31st July 2016 saw investments worth $4.58bn in fintech. However, deal volume remains higher in North America and Europe, as the Asia-Pacific increase is due to big investments in a few select fintech companies in China. There have been 192 deals in Asia-Pacific so far this year, as compared with 509 in North America and 230 in Europe. ○Fintech players look to earn a place via savings lessons  【Bengaluru】Every night before going to bed, 22-year-old Tanvi Sharma (name changed), a professional gamer, spends up to an hour on Indian fintech blogs and education platforms learning about new investment tips and how different funds work. Fintech players across sectors, including financial marketplace BankBazaar and SME Lending player Capital Float, are increasing their focus on setting up education platforms and blogs as a long-term user acquisition strategy. They are increasingly focusing on educating users and disseminating information in the areas they specialise in. Online discount brokerage firm Zerodha has set up an education platform. With this approach, fintech players have seen success in terms of increasing brand awareness. ○21 banks to go live with Unified Payments Interface  【Mumbai/ Chennai】The National Payments Corporation of India (NPCI) on the 25th of August said the Unified Payments Interface (UPI) will go live for customers of 21 banks. A brainchild of the Reserve Bank of India (RBI) Governor Raghuram Rajan, the UPI, which works on single click two-factor authentication, will allow a customer to have multiple virtual addresses for accounts in various banks. The UPI app of 19 banks will be available on Google Play Store in two-three working days for download. The details of the service will be available on the websites of the 21 banks. 【News source】 China alone Outpaces West in Fintech Investments- Report China leads global investments in fintech followed by India: Accenture Fintech players look to earn a place via savings lessons Unified Payments Interface to go live for customers of 21 banks UPI just turned your phone into a bank ○One world: The aim of SEAnews ◆Recruitment of Ad-SEAnews CanvassersYour Comments / UnsubscribeSEAnews MessengerSEAnewsFacebookSEAnewsGoogleSEAnews eBookstoreSEAnews eBookstore(GoogleJ)SEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |