|

||||||||

|

|

|

2016-07-03 ArtNo.45799

◆Brexit: Cataclysmic shock, but here’s what India must do

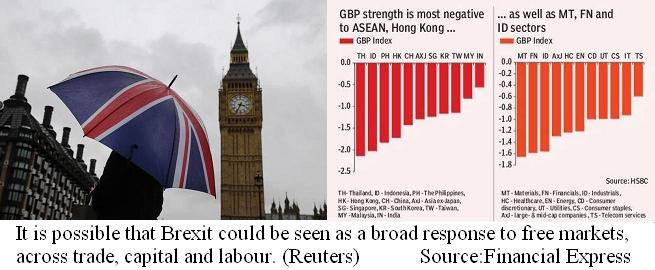

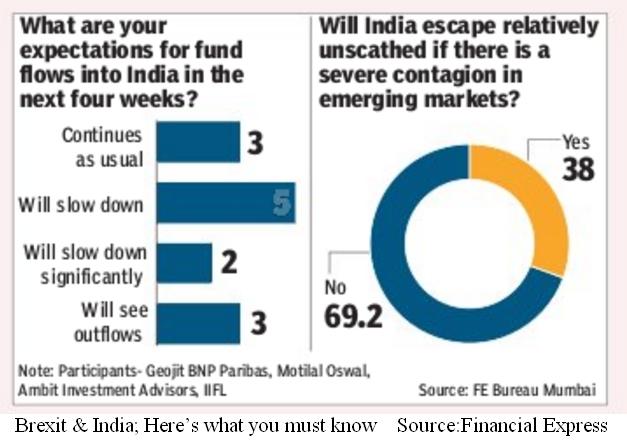

【New Delhi】This summer is turning out to be an extremely eventful one. Britain has voted to leave the European Union—a result that appears to have been unexpected by many. While this may have many (unintended) near- and long-term consequences for broader economic growth, corporate financials, and asset allocation, including equity performance, in this report, we focus on one more immediate factor: GBP volatility. Generally speaking, volatility in currency markets impacts the discount rate. It also shifts profits between countries and sectors. It can also create translation effects—assets (or debt) in dollars will now translate into higher local currency assets (or debt). Using regression analysis, we identify which markets, sectors and stocks are most and least sensitive to these factors. These are primarily found in ASEAN—given changes in the discount rate—and in Hong Kong (due to translation effects and operations run by Hong Kong companies in the UK). ○Brexit & India; Here’s what you must know  【Mumbai】With shares of Indian companies not staying immune to a global selloff, which followed the Britain’s decision to exit the European Union, FF conducted an opinion poll of top fund managers and market participants in India and abroad to figure out if Friday’s panic was a one-day affair or it is likely to continue in the short to medium term. Will India escape relatively unscathed if there is a severe contagion in emerging markets? Yes:30.8%, No:69.2%. ○Look! Brexit has thrown up wonderful opportunity for Indian equity investors  【New Delhi】The Nifty50 opened the week with the news of the RBI Governor exiting in September, which made some quarters of the media to expect a correction. The market, however, rose sharply, showing strength. With Britain wanting to leave the EU, the existence of the EU is now in question. Leaving will not be so easy, though, as there will be prolonged negotiations in Brussels. Remote chances are that Britain will just negotiate better terms and continue to remain an EU member. High volatility is expected, especially in currencies. 【News source】 Brexit: Cataclysmic shock, but here’s what India must do Brexit & India; Here’s what you must know Look! Brexit has thrown up wonderful opportunity for Indian equity investors ○One world: The aim of SEAnews ◆Recruitment of Ad-SEAnews CanvassersYour Comments / UnsubscribeSEAnews MessengerSEAnewsFacebookSEAnewsGoogleSEAnews eBookstoreSEAnews eBookstore(GoogleJ)SEAnews world circulation |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |