|

||||||||

|

|

|

2015-09-16 ArtNo.45496

◆How Finance Ministry and RBI brace for global financial ripples

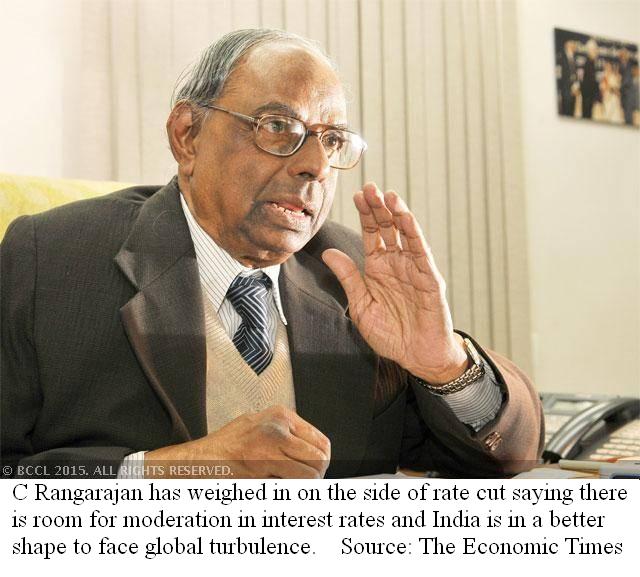

【New Delhi】Global jitters and plunging stock markets are beginning to worry the government, with an inter-regulatory Early Warning Group (EWG) comprising officials of the Reserve Bank of India (RBI) and the finance ministry bracing for action should conditions worsen. The group, which met earlier this week to deliberate authorities' response to a further worsening of China's economic crisis and the impact of likely interest rate increase in the US, has decided to watch the situation closely for some more days while dusting up measures that can be rolled out should there be a flight of capital that can weaken the rupee and destablise the economic recovery, officials familiar with its deliberations told the Economic Times. ○Markets should not fear volatility: Raghuram Rajan  【Ankara】Amid concerns in India and other global markets about uncertainty over a rate hike in the US, RBI Governor Raghuram Rajan on the 4th of September sought to play down fears saying markets should not be scared of volatility as it would be transient in nature. He also said finance “is only a lubricant to growth” and it would be the overall economic policies of the countries that would determine their basic growth momentum. Addressing the plenary session of the B20 meet, an informal grouping of business leaders from G20 countries, Rajan referred to issues facing the global economy and said the problems include people saving more and spending less, low productivity and low investments. But the solution is that "we should not be scared of volatility", he said. Referring to uncertainties about a rate hike in the US, he said return to monetary policy normalcy would address the concerns over volatility in the future. ○Former RBI governor seeks rate cut  【New Delhi】Former Reserve Bank of India governor C Rangarajan has weighed in on the side of rate cut saying there is room for moderation in interest rates and India is in a better shape to face any global turbulence. "Right now CPI (consumer price index) inflation is below 4 per cent, which is below the target rate. I personally think unless there is something dramatic happening in the world economy, we could expect a rate cut in the next policy," said Rangarajan, who headed the Prime Minister's economic advisory council in the previous UPA government. 【News source】 How Finance Ministry and RBI brace for global financial ripples triggered by China Markets should not fear volatility: Raghuram Rajan Former RBI governor C Rangarajan seeks rate cut, says India fit to face global tumult SEAnews eBookstoreSEAnews eBookstore(GoogleE)Readers' VoiceYour Comments / UnsubscribePlease do not directly reply to the e-mail address which is used for delivering the newsletter. SEAnewsFacebookSEAnewsGoogle |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |