|

||||||||

|

|

|

2014-12-12 ArtNo.45382

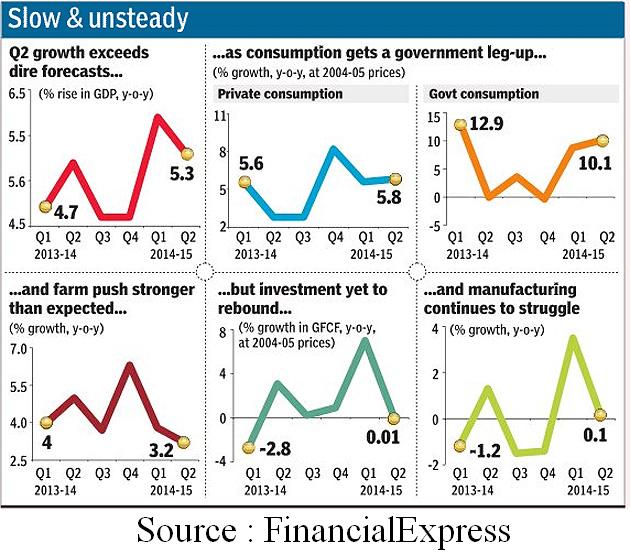

◆GDP grows at 5.3% in September quarter

【New Delhi】For the quarter ended September, India’s gross domestic product (GDP) grew 5.3 per cent, compared with 5.7 per cent in the previous quarter. However, the July-September quarter growth rate was higher compared to 5.2 per cent in the same quarter previous fiscal.

Poor showing by agriculture and manufacturing sector pulled down the country's economic growth rate. Especially the manufacturing sector expanded only 0.1 per cent, compared with 3.5 percent in the previous quarter. However, the Financial Express reports; The economy beat bleak forecasts to grow a decent 5.3% in the July-September period from a year before, aided by government expenditure and a better-than-expected performance by the farm and allied sectors. Expressing concern over subdued growth in the manufacturing sector, India Inc on the 28th November stepped up its demand for a cut in interest rate by RBI to give a leg-up to recovery both through higher consumption spending and opening up channels for investment. ○April-Oct fiscal deficit at 90% of full-year target 【New Delhi】The central government’s fiscal deficit for the first seven months of this financial year touched 4.75 lakh crore, or 89.6% of the budget forecast for 2014-15 as muted tax collections dragged down the overall revenue receipts. Net tax receipts in the first seven months of the current fiscal stood at over R3.68 lakh crore, or 37.7% of the original estimate, according to data released by the Controller General of Accounts on the 28th November. With data for five months yet to come, policy watchers have voiced concern on whether the 2014-15 fiscal deficit target of 4.1 per cent of gross domestic product will be met. “Achieving the fiscal deficit target is going to be difficult. The situation is always there to cut expenditure,” said Madan Sabnavis, chief economist at CARE Ratings. “We expect shortfall in tax revenues, especially with indirect taxes, due to weak industrial output and imports.” ○Forex reserves down by $672.4 million to $314.87 billion 【MUMBAI】The country's forex reserves dipped by USD 672.4 million to USD 314.878 billion due to a decline in core currency assets. Total reserves were up by USD 419.4 million to USD 315.55 billion during the previous reporting week, the Reserve Bank of India (RBI) said here on the 28th November. Foreign currency assets, a major constituent of overall reserves, decreased by USD 664.3 million to USD 289.398 billion for the week ended November 21, the RBI said. 【News source】 At 5.3%, GDP growth beats estimates GDP growth slips to 5.3 pc in Q2 Farm, services save the day; GDP growth at 5.3 pct in Q2 India Inc presses for rate cut after GDP growth slips in Q2 April-Oct fiscal deficit at 90 pct of full-year target April-October Fiscal Deficit hits 89.6% of FY15 target Forex reserves down by $672.4 million to $314.87 billion SEAnews eBookstoreSEAnews eBookstore(GoogleE)Readers' VoiceYour CommentsSEAnewsFacebookSEAnewsGoogle |

|

[Your Comments / Unsubscribe]/[您的意见/退订]/[ご意見/配信停止]

Please do not directly reply to the e-mail address which is used for delivering the newsletter. 请别用递送新闻的邮件地址而直接回信。 メールをお届けした送信専用アドレスには返信しないで下さい。 |